Impact-Linked Finance

Impact-Linked Finance is all about unleashing the full potential of (impact) enterprises by providing better terms for better impact. It’s not only about moving money – it’s about making a difference.

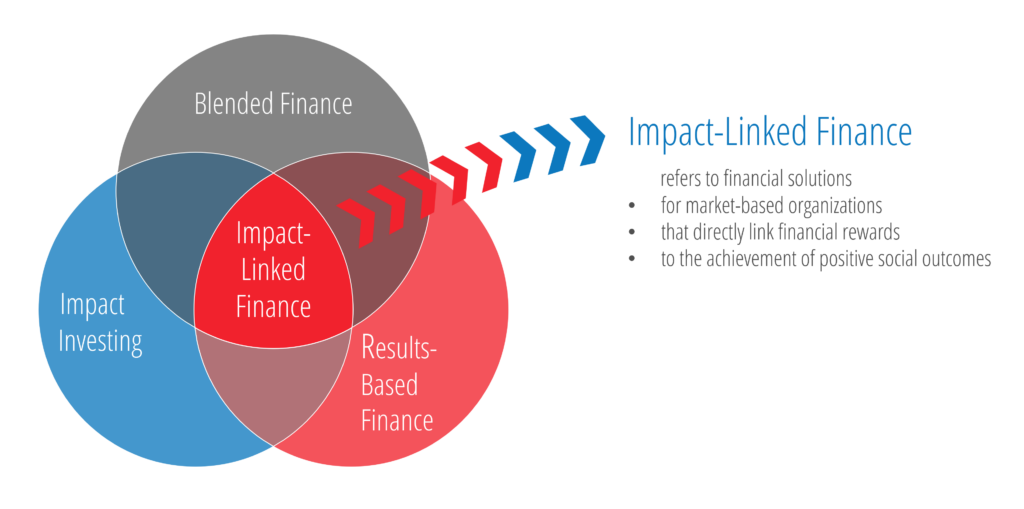

Impact-Linked Finance refers to linking financial rewards for market-based organizations to the achievements of positive social outcomes. It is an effective way of aligning positive impact with economic viability and lies at the intersection between blended finance, impact investing, and results-based finance. We defined the practice of Impact-Linked Finance together with the Boston Consulting Group (BCG) as the next logical step in the evolution of SOCIAL IMPACT INCENTIVES (SIINC). If you want to know the bigger mission behind this innovative practice, read more about HOW WE STRIVE TO REINVENT FINANCE.

Design & Features

Rewards for positive outcomes can be built into financing instruments across the board, from equity and debt to guarantees. For example, lenders can link the interest rates of loans to pre-defined impact performance metrics, decreasing the rate as this impact is achieved. Here, the ‘Impact-Linked Loan’ effectively lowers financing cost and creates a strong incentive for enterprises to outperform on positive impact. It is a powerful way to ‘bake’ impact into the core of finance. This approach is particularly appealing to catalytic funders and ‘impact first’ investors.

Principles

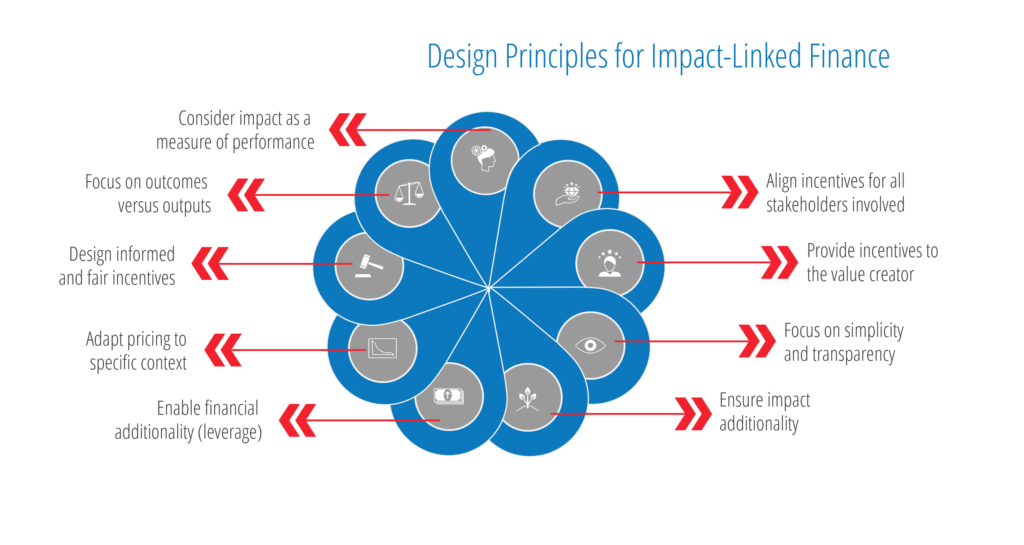

To deliver on its promise Impact-Linked Finance has to follow basic principles. Below is a list of select features and design principles that define and differentiate good practice:

Incentives to the value creator

Financial rewards should be directed to the primary value creator.

Focus on outcomes as opposed to outputs

Impact-Linked Finance instruments are based on outcomes or proxies of outcomes – not outputs – and measure these wherever feasible, useful, and economically viable as triggers for determining the level of financial rewards.

Impact additionality

The financial rewards in these instruments should drive the organizations to deliver additional outcomes that would not have happened without these incentives.

More design principles

The Design Principles for Impact-Linked Finance were formulated to promote the most effective use of Impact-Linked Finance. They represent a springboard for a broader involvement of practitioners, experts, academics, and other stakeholders invited to contribute. DOWNLOAD THE ENTIRE DESIGN PRINCIPLES

Impact-Linked Finance in Practice

About the Impact-Linked Finance Fund

Roots of Impact and iGravity established the IMPACT-LINKED FINANCE FUND in order to pool know-how and activities for implementing scalable programs (called „Impact-Linked Funds“). The Fund, set up as a Dutch non-profit foundation, is acting as a capital provider and knowledge hub for the practice of Impact-Linked Finance. We also advocate for embedding impact-related principles and terms in other areas of business, policy and finance. If you are interested in becoming an Impact-Linked Finance practitioner, the OPEN PLATFORM FOR IMPACT-LINKED FINANCE is a wonderful place for you to get started.

More food for thought?

If you would like to stay up-to-date on Impact-Linked Finance, feel free to REGISTER FOR THE IMPACT-LINKED FINANCE FUND NEWSLETTER, check out our SIINC CASE STUDIES or read the LATEST PUBLICATIONS on related subjects. For concrete Impact-Linked Finance solutions, this INNOVATIVE FINANCE TOOLKIT is a great resource that we prepared together with our partners in the B-Briddhi program.

Impact-Linked Finance Transactions

Many transactions brewing in various programs

As of year-end 2022, we have 44 Impact-Linked Finance transactions closed in various programs and additional 59 transactions planned. Out of the closed transactions to date, 24 ARE USING SIINC, 10 Impact-Ready Matching Funds (see our B-BRIDDHI PROGRAM in Bangladesh) and 10 Impact-Linked Loans or Impact-Linked Revenue Sharing Agreements. If you would like to know more about these Impact-Linked Finance solutions and how they work, we highly recommend this INNOVATIVE FINANCE TOOLKIT that we prepared together with our partners in the B-Briddhi program.

To follow the evolution of this innovative practice from building SIINC to an increasingly global community of practitioners, we have MAPPED OUR JOURNEY for you. For evidence that Impact-Linked Finance works (if well designed and implemented), you can study this short EVIDENCE SUMMARY.